Beyond Digital Gold: Bitcoin as a Stablecoin Highway

Lightning integrations by Tether and Circle could shift billions in daily volume to Bitcoin’s payment infrastructure

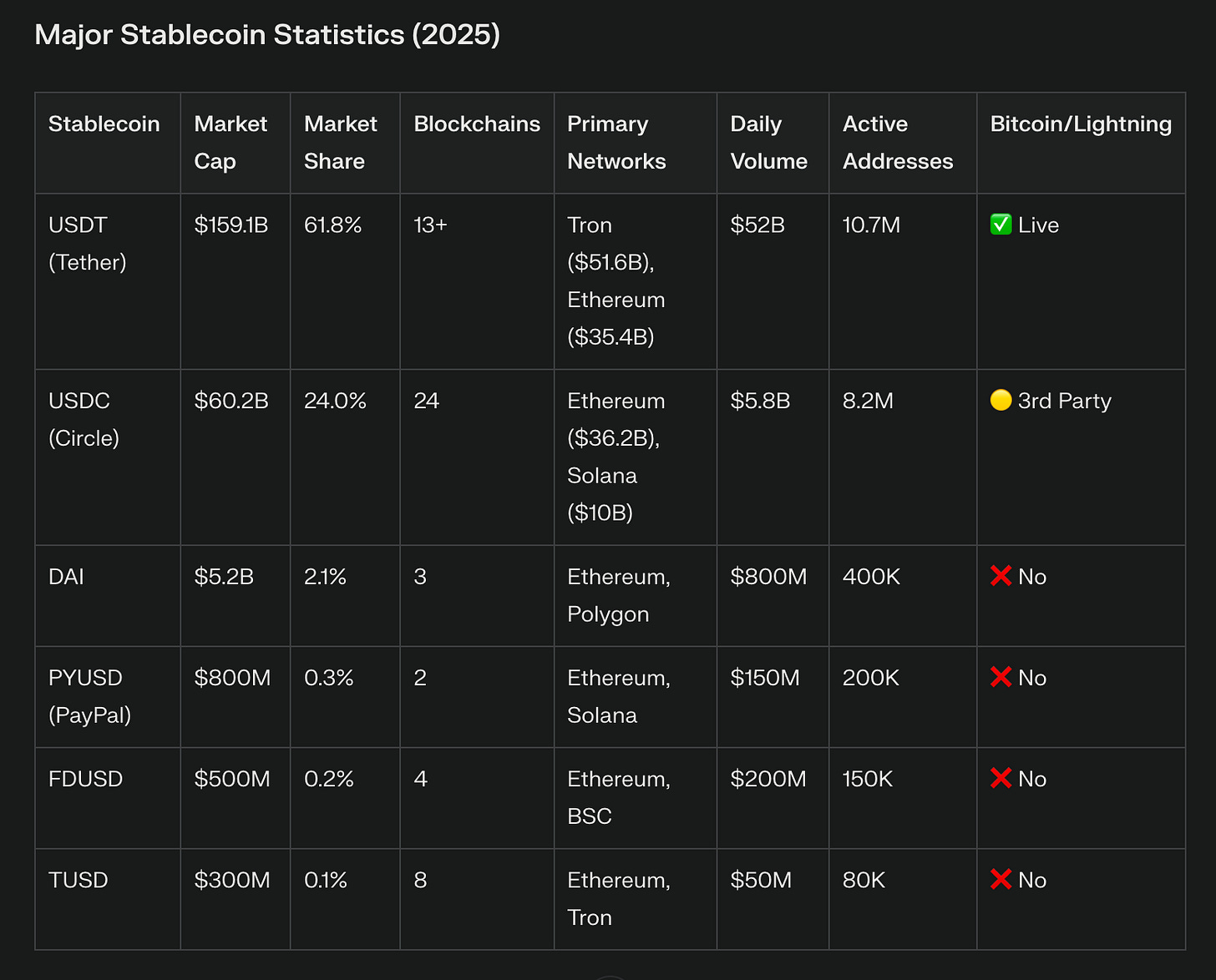

The largest stablecoin issuers moving to the Lightning Network, together with the passage of the GENIUS Act, have created a scenario I think few would have predicted a year ago: Bitcoin infrastructure is quietly emerging as a practical, and in some cases superior, backbone for global payments & remittance—offering something that legacy systems are struggling to match.

On January 30, 2025, at the Plan ₿ Forum in San Salvador, Tether CEO Paolo Ardoino and Lightning Labs CEO Elizabeth Stark unveiled a development that, for many in the crypto sphere, felt like a turning point. USDT—the world’s most widely circulated stablecoin, with $139.4 billion outstanding—would now run natively on Bitcoin’s Lightning Network. (tether.io) (coindesk.com) More than just a technical milestone, it signaled Bitcoin’s evolution from speculative asset to a real-world payment engine, especially for businesses & individuals trying to move money across borders.

The technical details are dense but crucial. Lightning Labs’ Taproot Assets protocol, building on Bitcoin’s 2021 Taproot upgrade, allows USDT to operate on both the Bitcoin base layer and Lightning’s faster, more scalable rails. (See Lightning Engineering, Kucoin analysis) “Millions of people will now be able to use the most open, secure blockchain to send dollars globally,” Stark said at the event. (coindesk.com)

But the real intrigue lies not in the technical rollout, but in what followed.

The Settlement Revolution

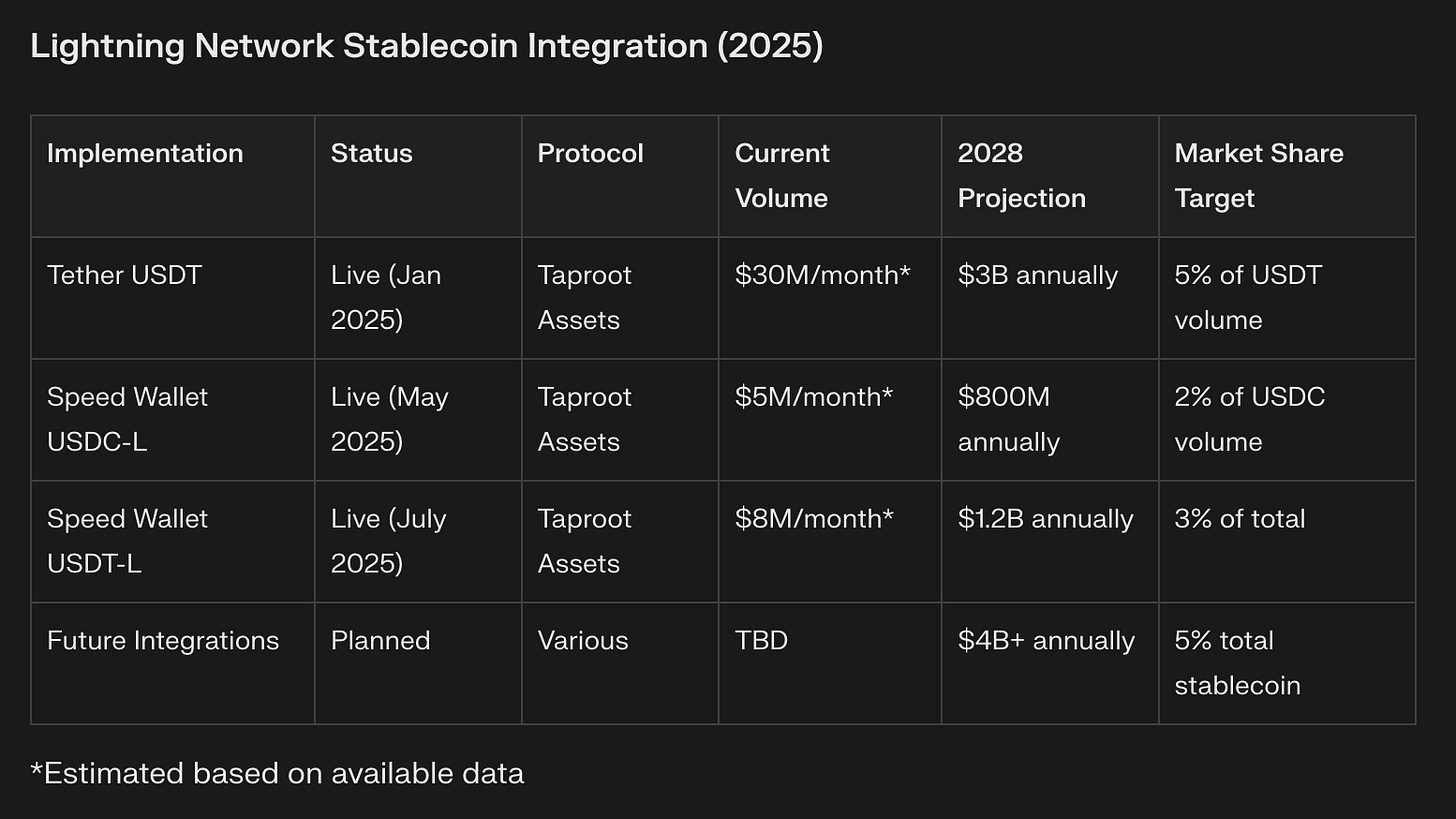

In the 6 months since the announcement, enterprise adoption has picked up at a pace that’s surprised even some insiders. Speed Wallet, a Dubai-based payments startup, launched USDT-L (USDT on Lightning) in July 2025. The company now handles thousands of business transactions a day, charging just 0.05% in fees, compared to the 2-4% typical for legacy payment systems. (Speed Wallet) Their user base has ballooned past 500,000, with clients ranging from e-commerce shops to freelance platforms integrating Lightning-based stablecoin settlements. (Google Play)

Voltage CEO Graham Krizek, whose company provides Lightning payment infrastructure, projects the network could capture at least 5% of global stablecoin volume by 2028—roughly $9 billion annually at current volumes. (Cointelegraph)

The numbers are eye-opening. Daily stablecoin volume hovers near $180 billion, with traditional networks charging anywhere from $0.50 to $7 per transaction—while Lightning’s costs are just a tiny fraction of that. (Cointelegraph, TrySpeed)

Jesse Shrader, CEO of Amboss, frames it as a fundamental shift: “Up until this year, if people or businesses wanted to switch to Lightning, they needed to have bitcoin first—and that’s a huge barrier. But this year we’ve removed that barrier, and consumers can pay with another asset—USDT. There’s already a large market for that.” (Bitcoin Magazine)

Lightning transactions settle in milliseconds, with a reported 99% success rate—a far cry from wire transfers that can take days and depend on banking hours. (Fidelity Digital Assets Report)

Enterprise adoption is snowballing across sectors. Fintech firms are launching “stablecoin-powered financial accounts accessible to businesses in 101 countries.” (Baker McKenzie) Speed Wallet’s API now lets companies accept Bitcoin, USDT, and USDC seamlessly, with real-time currency conversion. (TrySpeed)

These developments arrive just as stablecoin volumes are catching up to—and sometimes surpassing—traditional payment networks. In Q1 2025, stablecoin transaction volume topped $6 trillion, edging out Visa’s quarterly numbers. (PYMNTS) One analysis put it plainly: “USDT and USDC combined now account for over 70% of on-chain transactional value across leading blockchains.” (TrySpeed)

Tether CEO Paolo Ardoino views the Lightning integration as both strategic and practical: “By enabling USDT on the Lightning Network, we are not only reinforcing Bitcoin’s foundational principles of decentralization and security, but also creating practical solutions for remittances, payments, and other applications that demand speed and reliability.” (Tether)

What's remarkable is the simple practicality. Businesses are integrating Lightning Network stablecoins because traditional payment infrastructure can't compete with instant settlement, near-zero fees, and 24/7 uptime.

Lightning Network Stablecoin Integration (2025)

*Monthly transaction volume estimates.

B2B Payment Rails

Why are companies so eager to integrate? It comes down to economics + functionality - a winning combo in my book. For firms handling thousands of cross-border payments monthly, the cost gap between traditional banking rails and Lightning-powered stablecoins could make a real dent in their bottom line.

Take Steak ‘n Shake, the international fast-food chain. By shifting payments to Lightning, the company reportedly cut its processing fees in half compared to credit cards—while also seeing continued transaction growth. (Aurpay) COO Dan Edwards summed it up: “Bitcoin is faster than credit cards.” (Aurpay)

The broader enterprise infrastructure is maturing as well. Lightspark now offers a platform that lets companies plug into Lightning through a single API, automatically handling liquidity, compliance, and payment routing. The experience is getting closer to email: businesses can send and receive payments using human-readable addresses like jane@company.com, thanks to Universal Money Address integration. (Lightspark)

Certain sectors are especially quick to jump in. Freelance platforms are using Lightning for “instant, low-fee global payments to contributors in emerging markets,” while gaming firms use it to pay out winnings in real time. (Lightspark) Marketplaces are settling invoices without the pain of currency conversion or slow settlement.

Compliance and regulatory tools are catching up, too. TaxBit and Voltage have integrated real-time Lightning payments with automated compliance and reporting. (TaxBit) Aaron Jacob, VP of Accounting at TaxBit, notes a perceptible shift among regulators: “We’re witnessing a dramatic shift in tone from regulators like the SEC and Federal Reserve.” (TaxBit)

Adoption numbers tell the story. Lightning now reaches over 600 million users via integrations with major exchanges and apps like Coinbase, Binance, and Cash App. Bobby Shell, VP of Marketing at Voltage, calls Lightning “mature infrastructure,” arguing that “Bitcoin has been chosen by institutions as the most trusted digital asset, and now Lightning provides programmable money for instant and global payments.” (TaxBit)

Cost comparisons lay the case bare. Traditional wire transfers still run $15-50 each (plus exchange markups), while stablecoin payments are usually under $5—and often less than $1. (XAIGATE) And for companies moving serious volume, Lightning’s near-instant, sub-cent transactions are a game-changer. (Fidelity Digital Assets)

Cross-Border Remittance Transformation

But perhaps the most striking impact is in the remittance corridors where “TradFi” rails have long failed ordinary people.

In most countries around the globe, the payments landscape is complicated: PayPal doesn’t allow inbound transfers, Western Union takes a hefty 10-15% cut, and bank wires can cost $50 and take days. (Cointelegraph)

Lightning Network stablecoins are popping up as a new alternative—quick, cheap, and accessible. Bitnob CEO Bernard Parah describes it simply: “The same way someone pays for a cup of coffee in New York City is the same way they can now casually send $10 back home in Nigeria.” (Blink)

Numbers back up the story. A survey of freelancers in the US, Brazil, Argentina, Mexico, and the UAE found that 93% wanted at least some of their pay in crypto or stablecoins. In the UAE, 80% preferred stablecoins over traditional banks. (Yahoo Finance, Lara on the Block)

Lightning-based remittances are scaling fast: cross-border payments grew by more than 24 times between 2022 and 2024. (Lightspark) While the global remittance market exceeds $800 billion, Lightning’s share is still small, but growing rapidly. (World Bank) Infrastructure players like Strike now let users send dollars that turn into local currency on the other end—no technical wizardry required.

Technical Implementation

It’s worth pausing on how this all works. Lightning’s stablecoin capabilities are built on the Taproot upgrade—activated after overwhelming miner consensus in late 2021. (OSL) Taproot brought three key improvements: Schnorr signatures (for efficiency), Taproot scripting (for privacy and flexibility), and Tapscript (for programmability). (Chainalysis)

The breakthrough, though, is Taproot Assets, a protocol from Lightning Labs. It lets developers embed stablecoins within Bitcoin’s own payment channels, so they inherit the network’s security and can be swapped instantly for bitcoin or other assets. (Lightning Engineering, Samara AG)

This technical leap means stablecoins can use Lightning’s rails without spinning up their own networks. Transaction sizes shrink thanks to Schnorr signatures, and Taproot Assets v0.6 (released in June 2025) now supports ongoing, large-scale stablecoin issuance.

The upshot? Stablecoin issuers can plug into Lightning’s existing infrastructure—5,400 BTC is currently allocated to the network—without reinventing the wheel. They get the speed, security, and programmability businesses need, while retaining the price stability that’s made stablecoins popular.

Regulatory Evolution Needed

For all the progress, there’s still a regulatory hurdle—one that’s proving stubbornly persistent. In the US, both Bitcoin and stablecoins are treated as property by the IRS. That means every transaction, even Lightning-based stablecoin payments, is potentially a taxable event, requiring gain/loss calculations and reporting. (CryptoTaxCalculator, TokenTax)

While stablecoin gains are usually minimal, the compliance burden is real. New tax forms like the 2025 Form 1099-DA add reporting headaches, even as tax experts note that using stablecoins tends to “reduce capital gains exposure” versus volatile assets like Bitcoin. (Chainwise CPA)

This helps explain adoption patterns: B2B payments make up half of all stablecoin volume ($36 billion a year), while consumer retail spending accounts for just 18% ($13 billion). (Architect Partners) Large enterprise treasury teams are better equipped to handle the compliance load than individual consumers.

Internationally, things are moving faster. The US’s GENIUS Act, passed in July 2025, gives stablecoin businesses a new regulatory framework. Meanwhile, Hong Kong and the EU have both rolled out their own rules. (Ainvest, World Economic Forum) Aaron Jacob at TaxBit notes a perceptible shift in tone among regulators: “We’re witnessing a dramatic shift in tone from regulators like the SEC and Federal Reserve.” (TaxBit) The TL;DR: big crypto firms are now pursuing banking licenses, signaling that regulated stablecoin infrastructure is here for the long haul.

What’s needed? Clearer guidelines that separate speculative trading from real-world business use—perhaps with safe harbors for low-value transactions or simpler reporting for routine payments. Until then, Lightning-powered stablecoins will likely remain an enterprise tool, not a mainstream consumer payment option.

Future: When Tax Treatment Catches Up

The direction of travel seems obvious, but the speed is anyone’s guess. Bitcoin’s Lightning Network is morphing from a niche experiment to a foundation for business payments, thanks to advantages that are tough to ignore.

If Lightning captures even a sliver—say, 5%—of stablecoin volume by 2028, that’s $9 billion a year routed through Bitcoin. (Cointelegraph) Considering that annual stablecoin volume already tops $27 trillion, even small percentages add up fast.

Some signs of regulatory progress are emerging. Circle’s IPO and stock surge show that investors are betting on regulated stablecoin infrastructure. Bobby Shell at Voltage puts it simply: “Bitcoin has been chosen by institutions as the most trusted digital asset, and now Lightning provides programmable money for instant and global payments.” (TaxBit)

The network effect is kicking in: more merchants accepting Lightning means more value for users, which draws more developers and better tools, feeding the cycle. The ecosystem is maturing, and the technical capabilities are converging with practical business needs.

Bitcoin’s shift from digital gold to stablecoin highway could turn out to be the moment crypto stopped being a sideshow and started remaking the pipes of global finance—faster, cheaper, and, bit by bit, more accessible.

The revolution isn’t theoretical anymore. It’s playing out in transaction data, in cost savings, and in the quiet realization among businesses that Bitcoin might just be a better way to move money. The only real question left is: how long will it take for the rules to catch up?