The Movement to Anchor Stablecoins on Bitcoin

Tether and Circle are converging on Bitcoin, each with a different vision for how money could move at internet scale.

In June 2025, Tether launched USDT on Bitcoin’s RGB Protocol, and in August 2025, it co-funded the Plasma sidechain — two opposing paths toward Bitcoin-native stablecoins.

Circle, issuer of USDC, is approaching the same goal from the opposite direction, piloting Taproot Assets and Lightning integrations to bring regulated stablecoins to Bitcoin.

Together they reveal a new balance between privacy and compliance, minimalism and usability, as Bitcoin evolves from store of value to settlement layer for the digital-dollar economy.

I. Why Bitcoin-Native Stablecoins Matter Now

In the summer of 2025, the world’s largest stablecoin quietly redrew Bitcoin’s technical map.

Tether’s announcement that it would bring USDT to the RGB Protocol, a privacy-focused Layer 3 built atop Bitcoin and Lightning, signaled that stablecoins and Bitcoin were no longer separate conversations. And while Tether built outward from Bitcoin’s edges, Circle began building inward from the U.S. banking system, two empires racing toward the same neutral ground.

Three forces converged to reopen the question of Bitcoin’s role in digital dollars: regulation, infrastructure, and market pressure.

The GENIUS Act transformed stablecoins from grey-market instruments into federally sanctioned digital cash. Compliance became a moat, not a handicap.

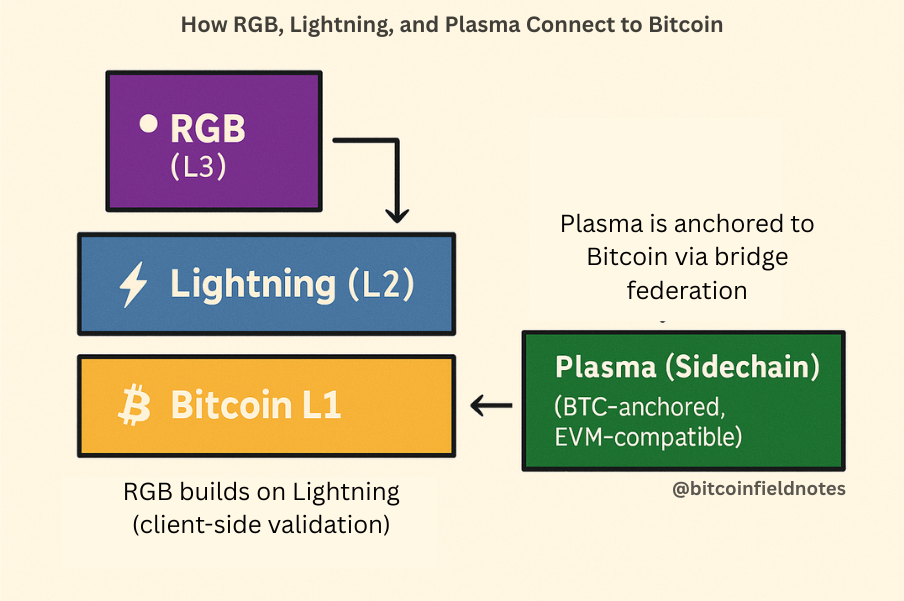

Taproot, activated in 2021, quietly enabled protocols like RGB, using “single-use seals” to attach assets to Bitcoin’s UTXO model. Plasma soon followed, an EVM-compatible sidechain secured by BTC collateral.

Meanwhile, Lightning’s Taproot Assets protocol proved that fiat-denominated tokens could move across Bitcoin’s instant-payment rails. The walls between “digital gold” and “digital dollars” were dissolving.

II. The Hedge – Inside Tether’s Dual Bet on RGB and Plasma

On the surface, RGB and Plasma could not look more different.

RGB embeds assets directly into Bitcoin’s UTXO structure via client-side validation: no global state, no extra chain, just cryptographic proofs exchanged peer-to-peer through Lightning.

Plasma is a full EVM-compatible sidechain collateralized by BTC, offering smart-contract composability and auditability.

RGB is the maximalist’s ideal: private, decentralized, zero-change to consensus, but it suffers from complexity and thin adoption. Plasma is its mirror image: fast, compliant, and developer-friendly, though it relies on federation trust.

Together they form Tether’s infrastructure hedge: one bets on ideology, the other on integration.

III. Lightning’s Middlegame: The Router That Binds

Lightning was never meant to do everything. It was meant to do one thing fast. That modest design now makes it the neutral switchboard of Bitcoin’s emerging monetary fabric.

With Taproot Assets and stablecoin extensions, Lightning can route digital dollars as easily as sats. RGB uses it for private transport; Plasma will rely on it for compliant last-mile payments.

Lightning’s architecture trades capital efficiency for security. Every payment channel must be funded in advance and balanced across participants, ensuring users retain custody of their funds at all times. But that safety comes at a cost: liquidity must be locked before it can move. Large or complex payments can fail if sufficient capacity isn’t already distributed along a viable route.

This makes liquidity management Lightning’s defining constraint. It’s not a weakness of design; it reflects the network’s trust model. The network functions like a collection of private corridors rather than a shared pool. This preserves sovereignty but complicates scaling. Operators must continuously rebalance channels and allocate capital efficiently to maintain throughput. As stablecoin flows join the network via Taproot Assets, this balancing act becomes even more critical.

Still, if RGB and Plasma represent rival philosophies, Lightning is the connective tissue, the practical layer where they meet the market. It turns the theoretical into the transactional, linking Bitcoin’s ideological purity with real-world utility.

Lightning doesn’t have to win the protocol war; it has to own the last mile.

IV. Bitcoin Native — by Ethos, by Security, or by Usability

In today’s market, calling a stablecoin “Bitcoin-native” is a powerful marketing edge, an appeal to ideology and user trust. But what does “Bitcoin-native” actually mean? In practice, each contender—RGB, Plasma, and Lightning—defines “native” through a different lens.

Ethos-native (RGB) means privacy and decentralization above all.

Security-native (Plasma) means BTC-anchored finality with programmability.

Infrastructure-native (Lightning) means interoperability and instant settlement.

As of now, it seems no stack captures all three…yet.

RGB: Ethos-Native

RGB prioritizes privacy and decentralization, aligning closely with Bitcoin’s client-validated, UTXO-based design. It’s the purest expression of Bitcoin minimalism: private and censorship-resistant, but possibly complex for users and light on liquidity.

The purist’s model: rooted in client-side validation, it keeps trust and state local.

The privacy laboratory: no global ledger, only exchanged proofs between counterparties.

The minimal footprint: transactions leave almost nothing on-chain, honoring Bitcoin’s small-base ethos.

The ideological benchmark: RGB defines what “native” means when purity, not adoption, is the north star.

RGB’s nativeness is philosophical — a bet that Bitcoin’s original minimalism can be extended without compromise.

Plasma: Security-Native

Plasma anchors directly to Bitcoin’s value layer while importing Ethereum-style programmability. It’s pragmatic and institution-friendly: transparent, auditable, and fast—but dependent on federated bridges and less philosophically “pure.”

The institutional bridge: connects Bitcoin’s finality to Ethereum’s programmability.

The compliance-ready chain: transparent, auditable, and built for enterprise flows.

The pragmatic layer: where Bitcoin’s economic gravity meets EVM flexibility.

The trust-managed compromise: security anchored to BTC, but coordination via federated validators.

Plasma’s nativeness is structural: secured by Bitcoin’s value layer, but optimized for composable, regulated scale.

Lightning: Infrastructure-Native

Lightning focuses on interoperability and instant settlement. As the payment fabric that already moves BTC globally, Lightning extends its reach to stablecoins via Taproot Assets. It’s where settlement happens: quick, practical, and nearly invisible.

The connective tissue, not the most private or programmable, but the most integrative system in Bitcoin’s emerging stablecoin stack.

The settlement fabric, the place where transactions resolve quickly and reliably.

The distribution layer, where adoption happens through wallets, merchants, and apps.

The infrastructure that operationalizes “Bitcoin-native” - it turns ideology and architecture into something usable.

Lightning’s nativeness is functional: the layer where all theoretical designs touch the real economy.

Each approach captures one dimension of “Bitcoin-nativeness”; none captures them all. Together, they sketch a triangle of trade-offs between ethos, security, and usability.

The future of ‘native’ stablecoins on Bitcoin looks more like orchestration than unification:

a network of specialized layers working in concert, complementing one another rather than competing.

V. The Stakes — How the Bitcoin Dollar War Ends

Whatever you believe Bitcoin to be—store of value, digital gold, or alternative money—it’s becoming something more in 2025: the settlement fabric of digital dollars. Each protocol imagines a different endgame.

Scenario 1 – RGB Future: Private money returns. Transactions become local proofs, not public ledgers. Liquidity fragments; privacy reigns.

Scenario 2 – Plasma Future: Bitcoin becomes a regulated settlement hub. Trillions in institutional stablecoin volume anchor to BTC-secured sidechains.

Scenario 3 – Lightning Future: Bitcoin becomes the transport layer: fast, asset-agnostic, routing liquidity between the other two.

Tether’s multi-stack strategy functions like portfolio diversification: privacy if regulation tightens, compliance if it loosens, routing revenue either way.

Yet Tether isn’t alone in reshaping Bitcoin’s monetary map. As one issuer builds optionality through decentralization, another is mapping a different route entirely—one paved in compliance.

The Circle Factor: Compliance Finds Its Way to Bitcoin

Circle, the issuer of USDC, approaches Bitcoin from the opposite direction: compliance first, infrastructure second.

After the GENIUS Act, Circle became the model issuer: audited reserves, bank-grade custody, and public-company accountability. Now it’s extending that regulatory credibility onto Bitcoin’s rails, translating its fintech playbook into protocol form.

Lightning / Taproot Assets.

Circle’s pilots with Lightspark and Voltage test USDC-over-Lightning for B2B payments and cross-border settlement: instant, low-cost, and final. These trials turn Lightning into a compliance-friendly conduit for regulated stablecoin flows.

Plasma.

A natural fit. Its EVM compatibility and transparent validator sets satisfy Circle’s audit requirements. USDC could launch there with minimal friction and full observability.

RGB.

Unlikely. Its encrypted, client-side architecture conflicts with Circle’s reporting obligations and audit standards.

Together, these moves are shaping a two-pole ecosystem:

Tether + RGB / Plasma → permissionless rails

Circle + Lightning / Taproot Assets → regulated rails

Bitcoin stands beneath both, neutral and indispensable: the monetary DMZ of the digital-dollar era.

Tether built liquidity from the edges of finance; Circle is rebuilding trust from its center. Their convergence on Bitcoin marks the closing of the stablecoin divide.

In 2025, the old line between offshore and regulated stablecoins has blurred. Tether now carries Wall Street credibility through Cantor Fitzgerald’s backing, while Circle exports Washington’s compliance model into Bitcoin’s new infrastructure.

[Insert Visual: Table 3 — Issuer Strategy Comparison (USDT vs USDC)]

VI. Bitcoin as the Settlement Layer for the Dollar Internet

Bitcoin’s third act is unfolding quietly: becoming the settlement substrate for digital dollars.

The dollar is already digital; what it has lacked is an immutable base. Bitcoin’s fixed rules and auditability make it that base. Ethereum provided programmability, Tron reach; Bitcoin provides finality.

As Lightning, RGB, and Plasma evolve, every stablecoin transaction increasingly seeks settlement against Bitcoin’s security. Bitcoin doesn’t compete with the dollar—it grounds it.

Lightning handles movement, Plasma handles logic, RGB handles privacy—together forming a polycentric monetary internet.

Economically, routing fees, bridge yields, and custody premiums tie network security directly to real demand for settlement.

Politically, the system balances transparency and autonomy: regulators get verifiable rails; users keep choice.

Tether’s infrastructure hedge and Circle’s compliance bridge both lead to the same outcome—Bitcoin as the neutral clearing layer of global finance.

Together, these layers don’t just expand Bitcoin’s functionality—they redefine its identity.

Bitcoin may no longer be what we store. It can become where we settle.*

Epilogue — Settlement as Story

History rarely names its infrastructures while they’re being built.

Gold was just metal until it became money.

TCP/IP was just plumbing until it became the internet.

Bitcoin remains an asset and a ledger, but it may be becoming something larger—an atmosphere for value, a language for exchange.

If this is the dollar’s internet, Bitcoin may be its quiet syntax: invisible, neutral, essential. It doesn’t announce itself in headlines or prices; it simply settles things—permanently.