When Dollars Need to Move Now: Stablecoins, Bitcoin Rails, and the Future of Humanitarian Cash

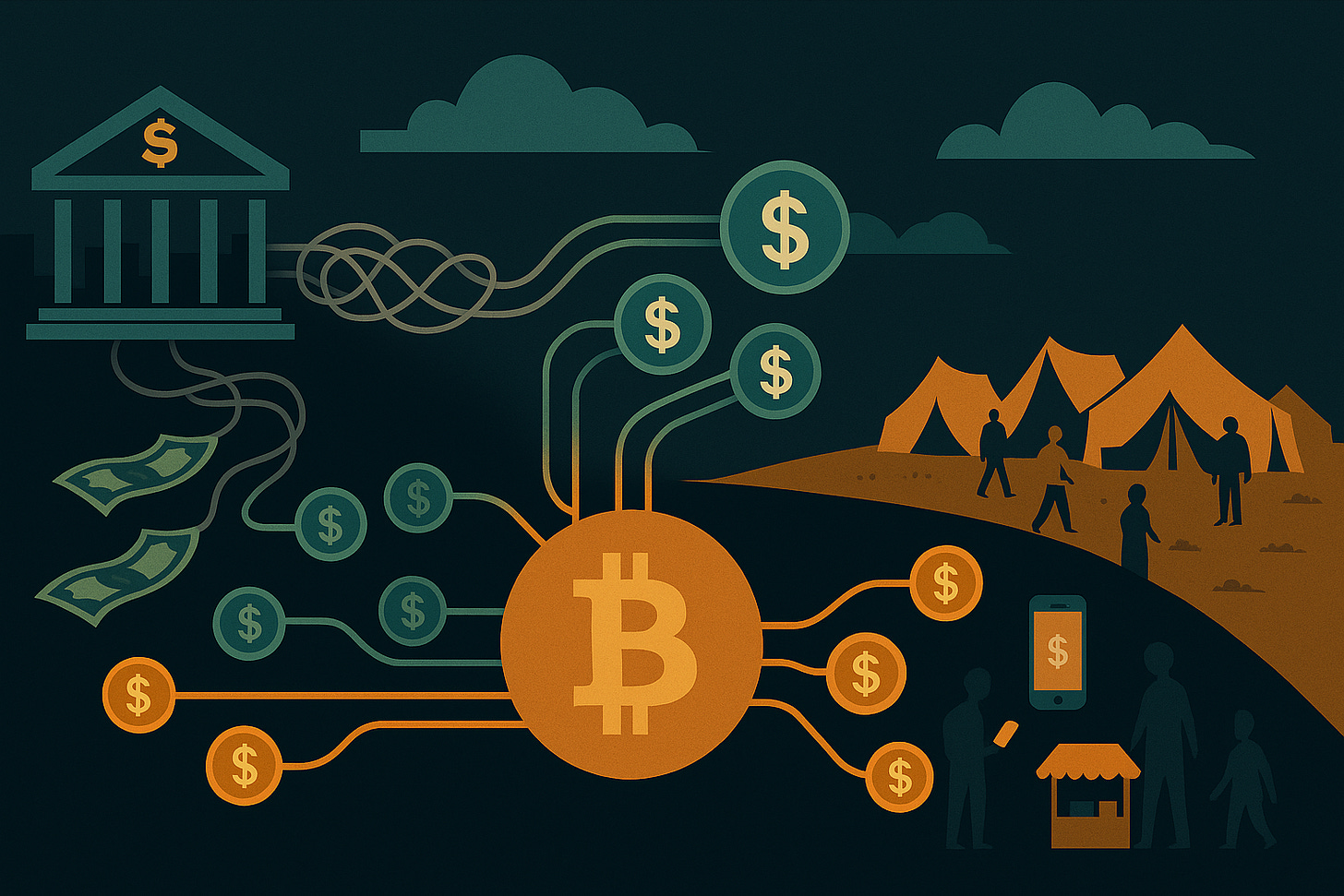

Stablecoin Lessons from International Aid, and the Case for Testing Bitcoin Rails

When the Money Moves Slower Than the Crisis

The program manager hits refresh again. The grant was approved almost three weeks ago. Headquarters released the funds. Somewhere between a European treasury desk and a fragile capital city, the money has vanished into the fog of correspondent banks and compliance queues. Vendors are waiting. Staff are fronting costs. A distribution everyone agreed was urgent is sliding quietly into next month.

Nothing is technically wrong. The wire is “in process.” The bank liaison is “following up.” The sanctions officer “needs to be sure.” Everyone involved can point to a rule, a checklist, a risk that must be respected. None of that helps the family that was told to come back in seven days and now hears two weeks, maybe longer.

In a different corridor, a smaller team does something that feels almost trivial. They approve a transfer on a web dashboard. A balance labelled in dollars appears in a local partner’s wallet that same day. A farmer’s payout arrives overnight instead of after the next settlement cycle. A refugee gets a message on a phone and walks to a nearby agent, cash in hand before the weekend. The program is still fragile, still messy, still full of human decisions. The money, however, moves.

The story is not hypothetical. It describes how humanitarian cash actually moves today.

Humanitarian agencies have already pushed through one big transition. They fought to replace in-kind aid with cash and vouchers wherever markets can respond. Now they are discovering that cash comes with its own infrastructure problem. Old rails carry new ideas only so far. High fees, slow settlement and derisking are not abstract policy debates. They show up as missed planting seasons, unpaid vendors and broken promises.

A first wave of blockchain and stablecoin pilots has tried to fix parts of this. Some of those experiments stayed in labs. Others reached conflict zones and refugee camps and have produced real numbers on time, cost and transparency. Almost all of them sit on permissioned ledgers, Stellar, or EVM based chains that were ready when the innovators went looking.

Bitcoin has mostly watched this from the sidelines. It has lived in reserves and risk registers, treated as a volatile asset rather than as plumbing. That is starting to shift. Lightning and related protocols now move value over Bitcoin at high speed. New layers can issue dollar denominated tokens that ride those rails while presenting simple balances in familiar units.

The question is not whether to chase the latest fad. It is simpler and more practical…Given what is now known from real stablecoin pilots, and given what Bitcoin based payment networks can actually do, how should agencies think about where stablecoins belong in their cash programs, and when it might be worth putting Bitcoin rails underneath the dollars that need to move tomorrow?

Part I: Stablecoins and humanitarian cash today

How humanitarian cash actually moves today

Over the last decade, humanitarian aid has quietly changed shape. Instead of shipping containers of food and blankets into every crisis, agencies increasingly send money and let people buy what they need from local markets. Cash and voucher assistance has moved from the margins into the center of the system.

Billions of dollars now flow each year as cash or vouchers rather than in kind support. For people on the receiving end, that shift often means more choice, more dignity and a better fit with local realities. For agencies, it promises cleaner logistics and lower overhead. The front end looks modern: digital transfers, payment cards, mobile money, QR vouchers.

Behind the scenes, though, the machinery is still mostly old.

The legacy cash stack

A typical humanitarian cash flow looks something like this:

Donors to headquarters

Government donors and multilaterals fund a big UN agency or INGO. Money moves through standard commercial banks.Headquarters to country offices and partners

HQ sends funds across borders using SWIFT, correspondent banks and sometimes international money transfer operators. Inside the country, offices work with local banks, mobile money providers, card issuers or informal networks.Partners to people in crisis

At the last mile, recipients see cash in envelopes, paper or digital vouchers, prepaid cards, mobile money balances, or direct transfers into bank accounts, depending on context and infrastructure.

On paper this looks workable. In practice, three issues keep showing up.

First, cost.

Global remittance data put average fees in the mid single digits as a percentage of the amount sent, and bank based transfers higher still. Humanitarian flows stack several layers of cost on top of that: FX spreads at more than one bank, intermediary fees, card program costs, agent commissions. No single line item looks outrageous, yet by the time funds reach a refugee camp or a rural village, a noticeable slice has evaporated into the plumbing.

Second, time and fragility.

Every cross border hop is a chance for delay. Compliance reviews, sanctions screening, de risking policies and simple operational backlog can turn an urgent transfer into a multi week process. In high risk corridors, banks sometimes choose to exit entire markets or routes rather than live with regulatory uncertainty. Programs that look fully funded on paper then sit waiting while country teams scramble for workarounds.

Third, visibility and coordination.

Each bank, MTO and mobile money provider maintains its own ledger. An agency might run one cash program through a commercial bank, another through mobile money, and a third through prepaid cards, all in the same country. Reconciling who received what and when can take weeks. Coordinating across agencies is even harder. Shared caseloads and overlapping mandates mean the same household can show up in multiple systems with no easy way to see duplication.

By the late 2010s, the sector had largely won the philosophical battle in favor of cash and vouchers. The bottleneck was no longer whether cash was appropriate. It was whether the financial rails beneath that cash were fit for the scale, speed and political exposure of modern crises.

That’s the backdrop for the first wave of blockchain and stablecoin experiments in humanitarian work. Agencies were not looking for a new ideology. They were reacting to very specific operational pain.

Why agencies started looking at stablecoins

Several motivations show up again and again in their own descriptions of these pilots.

Speed and reliability

When Mercy Corps wrote about its stablecoin pilots in conflict zones, it framed them as a response to slow, unreliable bank transfers that could take weeks and sometimes fail without clear explanation. UNHCR described its blockchain based Ukraine cash pilot as a way to reach people with speed and agility in a war zone, while still keeping a clear record for auditors and donors.

Lower transaction costs

In Mercy Corps documentation, Project Lydian shows double digit percentage savings relative to traditional financial service providers, enough to redirect budget to additional households. The HesabPay pilot in Northeast Syria reports sharply lower delivery costs than the informal money transfer agents that had been used before. The technology here is not exotic: fully backed dollar stablecoins, basic wallets, and carefully chosen off ramps. The savings come from cutting out stacked intermediaries.

Traceability and audit trails

WFP built Building Blocks in part to solve reconciliation problems between its own systems and those of commercial banks and partner agencies. Instead of asking each institution for periodic reports, the program writes vouchers and redemptions to a shared ledger that all participants can query. UNICEF and its Rahat partners talk in similar terms. Their interest is not speculative crypto gains. It is the ability to see fund flows from headquarters, to municipalities, to vendors, in close to real time.

UNHCR and Stellar present their Ukraine work along the same lines. Digital dollars move over a public chain. Personally identifiable information stays off chain. Program teams gain clearer evidence of who received assistance and when, without faxing spreadsheets between offices.

Inclusion when banking and card rails fall short

Many displaced people do not have a working bank account or safe access to a branch. Card infrastructure in lower income and fragile states can be patchy or expensive. Digital wallets and agent networks offer a different path. A refugee can receive value in a wallet, then cash out at a nearby agent when it is safe to do so. In some pilots, people without phones or IDs still participate via QR cards or supervised redemption at local offices, with the blockchain ledger handling the back office accounting.

A broader digitalization agenda

For some agencies, blockchain and stablecoins sit inside a larger push to modernize operations. UNICEF’s innovation work and venture investments, for example, frame blockchain as one component in a toolkit that also includes digital identity, new financing models and more automated data flows between partners.

Taken together, these motives explain why stablecoins in particular have attracted attention. They behave like internet native cash, yet they are denominated in familiar units such as US dollars. They can cross borders without as many correspondent banking hops. They leave a programmable transaction history that can feed straight into monitoring, evaluation and audit.

That is why the sector began to experiment. The next question is what these pilots have actually delivered in practice on time, cost, inclusion and governance, and where the gaps remain.

What we have actually learned so far

The past decade produced a lot of talk about “blockchain for good”. Very little of it survived contact with real crises.

A small group of programs did. Mercy Corps’ stablecoin pilots, WFP’s Building Blocks, UNHCR’s Stellar Aid Assist work in Ukraine, and UNICEF’s Rahat deployments in Nepal and elsewhere all pushed beyond slide decks and into the mud of actual implementation.

Taken together, they give a reasonably clear picture of what tokenized rails actually change, and what they do not.

Stablecoin rails compress time and cost in specific legs, not everywhere.

The last mile is about access, not protocol design.

Governance and process are the bottlenecks.

Transparency gains show up most clearly at scale.

Evidence gaps remain.

Stablecoin rails can compress time and cost in specific parts of the chain

Mercy Corps has published unusually concrete numbers from its first two stablecoin pilots.

Project Lydian, USDC grants in conflict zones

In one pilot, the organization used a platform called Lydian to send USDC from headquarters to four local partners in an active conflict setting. The baseline was familiar: multiple correspondent banks, multi week delays, opaque rejections. With USDC as the value carrier and a more direct off ramp, Mercy Corps reports roughly:

a move from transfers measured in weeks to transfers measured in days

around 10 to 11 percent cost savings compared with the previous stack of financial service providers

enough savings to reach about 10 to 12 percent more households on the same budget

HesabPay in Northeast Syria, USDC for farmers

A second pilot paid smallholder farmers in Northeast Syria through HesabPay, which wraps stablecoin rails inside a simple user experience. In this case Mercy Corps measured:

delivery time dropping from an average of 28 days to less than one day

around 60 percent reduction in delivery costs relative to informal money transfer agents

about 94 percent of every aid dollar reaching participants, up from 85 to 90 percent under previous methods

These gains sit in very specific legs of the chain. They show up when high friction, high risk international transfers are replaced with simpler, more direct digital flows. They do not replace field work. They do not remove the need for targeting or monitoring. They simply reduce drag between the spreadsheet in HQ and a partner’s ability to spend.

The same pattern shows up at larger scale in a different modality.

Building Blocks, food voucher style transfers on a shared ledger

WFP’s Building Blocks system supports cash based transfers for refugees in Jordan and Bangladesh using a permissioned blockchain. Public reporting indicates that the platform has:

processed hundreds of millions of dollars in value

served more than one million people

saved several million dollars in bank and intermediary fees over the life of the program

The important point is not the specific rail or asset. In all three cases, the benchmark is a real legacy process. Against that benchmark, tokenized rails consistently deliver faster settlement and lower delivery cost for the parts of the flow that suffer most from correspondent banking friction and derisking.

They do not magically fix the last mile.

The last mile is still about basic access, not clever token design

Once you leave treasury and step into a municipal office or a camp, the questions get very simple.

Does the person have a phone.

Do they have a bank account.

Can they reach a trusted place to cash out or spend.

The UNICEF and Rahat pilot in Jaleshwor, Nepal is one of the clearest examples of how serious programs handle this. The project targeted around one thousand nine hundred vulnerable households with young children. Each household received a modest cash grant through a blockchain based cash and voucher mechanism.

Instead of pretending everyone looks the same, Rahat split recipients into four groups:

unbanked and without a phone, who received QR code cards in sealed envelopes and redeemed them at ward offices or local shops

unbanked with phones, who received digital tokens linked to their mobile numbers and used one time passwords at vendors

banked with phones, who received standard bank transfers supported by SMS notifications

banked without phones, who were handled through bank transfers and manual reconciliation at the municipality

On the surface, the experience is familiar. People show a card, a code or an ID and receive cash or goods. Under the surface, the Rahat platform tracks value as tokens, logs every movement on a shared ledger and provides dashboards for staff.

Other programs follow the same principle.

Building Blocks uses blockchain on the back end, but in Jordan refugees authenticate with iris scans at supermarket style shops. They check out as they would in any controlled voucher system, and the ledger keeps the books underneath.

UNHCR’s Stellar Aid Assist pilot uses a mobile wallet plus the MoneyGram agent network in and around Ukraine. People receive notifications, install an app and can convert digital dollars to local cash at physical locations.

Across these cases, the constraint is not the design of the token. The constraint is the diversity of devices, literacy levels and financial access. Programs that reach unbanked or phoneless households do it by meeting those households where they are, then using a more modern ledger in the background to clean up the accounting.

Any future use of Bitcoin based or Lightning based rails in humanitarian settings will have to respect that reality. If a design only works for smartphone owners who are comfortable with self custody, it will exclude a large share of the people that cash assistance is meant to reach.

Governance and process have been harder than the technology

When Mercy Corps reflects on its stablecoin pilots, the main pain points are not technical. They are organizational.

Internal materials highlight the need to:

create a virtual asset policy and treasury checklist

define clear roles for who can authorize, initiate or reconcile stablecoin transfers

vet wallet providers, on ramps and off ramps with the same rigor as banks

integrate new rails into existing financial controls rather than running them as side projects

In other words, the tokens were not the hard part. The hard part was threading those tokens through finance, legal, risk, procurement and program delivery in a way that still satisfied donors, auditors and internal controls.

That story repeats in different language at UN agencies.

UNHCR’s Ukraine work runs on a Stellar based rail, but it is embedded inside a pre existing cash assistance framework that governs targeting, KYC and monitoring. The blockchain component replaces certain payment legs and the way value is stored between transfers. It does not replace the cash program itself.

Building Blocks is as much a governance platform as it is a technology. Multiple agencies and shops agree to coordinate through the same system, use shared identifiers and resolve duplication there instead of by exchanging spreadsheets.

The pattern is consistent. The limiting factor is organizational capacity and risk appetite. Moving tokens across a network is easy. Convincing a risk committee that this is a good idea and training hundreds of staff to operate it is not.

This is exactly where domain experience inside NGOs becomes an advantage. Translating between protocol capabilities and the slow language of governance and controls is a skill in short supply.

Transparency and coordination gains become visible at scale

Speed and cost savings are easiest to talk about. The subtler gains show up in how agencies see and coordinate flows once the system has been running for a while.

Building Blocks is the clearest example. Since its launch it has been described as the largest humanitarian blockchain implementation in the world, with more than one million people reached and hundreds of millions of dollars moved through it.

In Ukraine, WFP and partners used Building Blocks to coordinate large volumes of cash based aid across a group of organizations. Case studies report that by putting assistance data in one place, they were able to identify overlapping payments, reduce duplication and free up funds to support additional households that would otherwise have been missed.

Rahat, at a smaller scale, reports similar benefits. Program teams monitor token flows from UNICEF to municipalities to wards to end users in real time, verify that communications have gone out and enforce multi signature approvals on sensitive transfers. That visibility is directly aligned with the way donors and development finance institutions think about fiduciary risk.

UNHCR and Stellar regularly highlight the “follow the money” aspect of the Ukraine pilot. The chain records each digital dollar as it moves from the organization’s wallet into a beneficiary’s wallet and then out through a cash out partner, while personal data stays in conventional systems.

For agencies, this kind of transparency changes internal conversations. It makes reconciliation between headquarters and field offices less painful. It provides cleaner evidence for claims about how much funding reaches people directly. It also strengthens defenses against fraud and double dipping, which are constant concerns in large cash programs.

Human behavior is still doing most of the work

The technology can make certain things possible. People determine whether those possibilities matter.

In the HesabPay pilot, Mercy Corps saw a shift in attitudes once participants had lived with the system for a while. Many farmers who initially preferred cash reported that they liked digital payments once they experienced faster delivery and smoother interactions with vendors. Vendors, in turn, were critical in building trust, since they acted as the bridge between stablecoin denominated value and usable local money.

UNHCR’s reporting on Ukraine notes that people value the ability to carry funds safely on a phone across borders and then convert to local currency when it is safe. The contrast is with standing in visible lines for physical cash or travelling long distances to bank branches in a conflict environment.

Rahat’s case studies include stories of recipients who describe the process as “just like visiting the municipality office”. They do not talk about wallets or tokens. They talk about being treated like any other resident who has business with local authorities, rather than someone who needs charity in public.

On the implementer side, perceived risk is decisive. Teams are more comfortable when:

the stablecoin is fully backed and issued by a regulated entity

there is a clear path to cash out into local currency

the user interface looks like familiar fintech rather than a trading app

Those perceptions matter as much as the properties of the protocol. They shape how quickly pilots graduate into standard operating procedures.

Evidence gaps and open questions

For all the progress, there is still a lot that has not been measured.

Building Blocks has impressive operational statistics, yet independent evaluations that compare beneficiary welfare or cost effectiveness directly against comparable non blockchain cash programs are limited.

The UNICEF and Rahat work in Nepal and other locations includes detailed process reporting and rich qualitative material. It says less, at least in public, about strict before versus after comparisons of time, leakage or overhead.

UNHCR’s Ukraine pilot is still young. There is public information about total amounts delivered, numbers of people reached and headline user experience, but not yet a full cost effectiveness analysis that breaks out every component of cost and compares it to legacy options.

These gaps are understandable. Humanitarian agencies are operating in war zones and crises, not laboratories. But they matter.

They also point toward what a next generation pilot should try to do. A useful project would:

define a clear baseline for time, cost and the share of funds reaching recipients

use stablecoin rails in one arm and legacy rails in another, within the same overall program design

track governance and audit quality as seriously as speed and price

The current wave of pilots has already answered one question. Stablecoin and blockchain based systems can deliver real gains in speed, cost and transparency in humanitarian settings when they are designed carefully and aligned with NGO practice. The next questions are about resilience and choice of rail, including what might change when these same ideas are tested with Bitcoin secured stablecoins and Bitcoin based payment networks.

The table below compares three realities: the old system, documented stablecoin pilots, and the technical properties of Bitcoin rails.

Column 1 and 2 are based on measured humanitarian program data.

Column 3 describes network capabilities, not humanitarian impact.

Where pilots exist, stablecoins have already delivered time and cost gains.

Bitcoin rails are currently an untested substrate for this sector.

Part II: Bitcoin rails and the next pilots

From first wave pilots to Bitcoin secured rails

There is no large humanitarian cash program yet that runs entirely on Bitcoin anchored stablecoin rails. What follows describes the rails themselves, not results from aid programs.

The first generation of humanitarian pilots proved a narrow but important point. When fully backed digital dollars move over competent programmable rails, certain bottlenecks crack. Weeks become days. Double digit leakage shrinks. Reconciliation stops relying on half broken spreadsheets and late bank statements.

Those projects chose the rails that were available at the time. Permissioned ledgers, Stellar, and EVM based chains had live tooling, wallet support and development teams when WFP, UNHCR, UNICEF and Mercy Corps went shopping for infrastructure. That was the pragmatic choice. Bitcoin stayed mostly on the sidelines as a volatile asset, not as a payment network.

That context is now shifting.

Bitcoin as settlement fabric, not just an asset

Bitcoin spent its first decade earning a reputation as “digital gold”. Valuable, contentious, interesting, and mostly unsuitable for moving small amounts of value in a hurry. Block times sat around ten minutes, fees spiked under load, and the network felt more like a clearing house than a cash rail.

The Lightning Network changes that picture. Lightning is a second layer built on top of Bitcoin. It uses payment channels and off chain routing to move value in seconds or less, while anchoring final settlement back to the base chain. Academic work and industry reports now describe Lightning as a way to deliver instant, low fee payments without sacrificing Bitcoin’s security model.

Commercial players treat it the same way. Remittance focused firms and infrastructure providers market Lightning based cross border payments as a path to near instant, low cost transfers that can cut fees by large percentages compared with legacy rails, at least in corridors where liquidity exists.

Lightning on its own moves bitcoin. Humanitarian agencies do not want to pay vendors or refugees in bitcoin. They want dollars, euros and local currency equivalents. That is where the new layer of work on Bitcoin anchored assets comes in.

Three building blocks for dollar value on Bitcoin

The last few years have produced three pieces of infrastructure that matter for anyone thinking about stablecoins on Bitcoin.

• Lightning as a fast transport layer

Think of it as a fast lane built on top of Bitcoin that moves value in seconds.

Lightning is already a live network of nodes, channels and routing policies that can carry value across borders very quickly. It is used today for retail payments, remittances and machine to machine transactions, often inside consumer apps that hide the details from users.

The important property is simple. Once value is on Lightning, payments can be routed quickly and cheaply between any pair of connected participants. Protocol design keeps the final settlement anchor on Bitcoin, but most user level transactions never touch the base chain.

• Taproot Assets for multi asset transfers over Lightning

A way to issue and move dollar-like tokens over that fast lane.

Lightning Labs and others have built a protocol called Taproot Assets. It uses the Taproot upgrade on Bitcoin to issue and manage assets that are anchored to Bitcoin outputs, while moving those assets over Lightning channels. The official documentation describes it as a Taproot powered protocol for issuing assets on Bitcoin that can then be transferred over the Lightning Network for instant, high volume, low fee transactions.

Recent articles and releases describe Taproot Assets as a way to bring stablecoins and other tokens into the Lightning ecosystem, turning Lightning from a single asset payment network into a multi asset one.

In plain language, Taproot Assets lets a wallet show a user a dollar balance, route that balance over Lightning, and still settle everything against Bitcoin in the background.

• RGB for client side validated assets anchored to Bitcoin

A more private, client-side way to anchor tokens to Bitcoin.

RGB is another protocol that uses a different design to reach a similar end. It anchors commitments to assets in Bitcoin transactions, but keeps most of the state and validation on the client side. That approach aims to reduce congestion on the base chain, improve privacy and keep scalability high.

RGB reached a mainnet release in mid 2025. Publications covering the launch describe it as “tokenized asset support” on Bitcoin that can work together with Lightning to carry stablecoins and other assets.

Tether then made a public move that matters for this conversation. In August 2025 the company announced plans to launch USDT on RGB, describing it as native stablecoin support on Bitcoin and Lightning. The announcement and follow up coverage highlight three features in particular: privacy through client side validation, scalability, and the ability to move USDT over Bitcoin’s ecosystem as a first class asset rather than as a wrapped token on another chain.

If these implementations mature and gain wallet support, a humanitarian program would not need to interact with RGB directly. It would see a stablecoin balance and a provider who offers Bitcoin anchored rails under the hood, similar to how today’s pilots see USDC on Polygon or USDC on Stellar without touching protocol code.

The next step is not to assume these rails are better. It’s to design a pilot that tests them fairly against the best options that already exist.

How these properties map to humanitarian pain points

None of this is a humanitarian case study. It is infrastructure work. Still, several traits of this Bitcoin based stack line up with problems that humanitarian cash programs already face.

Resilience when correspondent banking fails

Bitcoin and Lightning do not depend on correspondent bank relationships. Nodes can route around institutional chokepoints as long as they have internet access and channel liquidity. Industry and academic pieces frame Lightning as a way to bypass some of the constraints of traditional cross border transfers while keeping strong security guarantees.

For humanitarian flows this does not remove the need for compliance. Agencies still need regulated on ramps and off ramps in each jurisdiction, plus careful KYC and sanctions screening. It does open the possibility that, if banks withdraw from a corridor altogether, the underlying rail remains available and the remaining constraint is local regulation and agent networks, not the physics of the network.

Speed as a given rather than a bonus

Lightning based transfers settle in seconds or less once value is on the network. That is true for bitcoin itself and, in principle, for assets carried via Taproot Assets or RGB.

First wave humanitarian pilots on other rails have already shown what happens when transfers shift from weeks to days or hours. The distinction here is that near instant settlement is a design property of the network rather than a feature of a particular provider or chain. For a treasury team that needs to move funds quickly into or across a high risk environment, that baseline speed has obvious appeal.

Fee structure and predictability

Network level fees on Lightning based payments are typically very low. Providers experimenting with Lightning remittances in commercial settings market fee reductions on the order of tens of percent compared with legacy models, by collapsing intermediary layers and using Lightning channels instead of correspondent banks.

In a Bitcoin anchored stablecoin model, the total cost of a humanitarian transfer would still depend on FX spreads and on ramp or off ramp margins. The difference is that the network fee component becomes small and predictable. When budget planning involves hundreds of millions of dollars in cash transfers, that predictability matters.

Interoperability across wallets and regions

Lightning already functions as an interoperability layer for a growing set of exchanges, wallets and merchants. Pieces from developers describe Lightning as a shared fabric that lets users move value between many different services without caring who runs which node.

If stablecoins are widely issued over Taproot Assets or RGB and routed via Lightning, NGOs could in principle plug into an existing mesh of wallets and payment providers rather than negotiating completely bespoke connectivity for each new corridor. That is a hypothesis, not a documented outcome, but it aligns with how Lightning is evolving in the retail and remittance world.

Limits and open questions specific to humanitarian use

All of these are technical and commercial developments. None of them changes an important fact. As of now there is no large public humanitarian cash program that runs directly on Bitcoin anchored stablecoin rails. There are announcements, early integrations and remittance case studies, but not the kind of program documentation that exists for Lydian, HesabPay, Building Blocks, Rahat or Stellar Aid Assist.

Several open questions follow.

How will regulators treat Bitcoin based stablecoin rails that are used in crises, especially where sanctions and counterterrorism rules are in play

Can NGOs obtain the same level of comfort with custody, key management and operational security on Lightning and RGB as they have begun to build on other chains

Will wallet support, liquidity and off ramp coverage for Bitcoin based stablecoins reach the same level of maturity that USDC and USDT enjoy on non Bitcoin networks

Until those questions have real case study answers, the honest way to treat Bitcoin secured rails in humanitarian planning is as a possibility, not a proven upgrade. The first wave of pilots has already shown what is achievable with digital dollars on other infrastructures. The next phase is to design a pilot that tests whether Bitcoin anchored versions of those dollars can match or improve on those results, especially in corridors where resilience and censorship resistance matter as much as speed and cost.

A pilot template for Bitcoin linked humanitarian cash

The first wave of stablecoin pilots left a set of clues about what works, what breaks, and what still needs to be tested. A useful Bitcoin pilot should borrow those lessons, change as little as possible in the program design, and swap only the rail underneath.

The outline below is a template that could be dropped into more than one setting, then tuned to local law and politics.

Two corridor archetypes

Start with where a new rail actually matters. Not every cash program needs it. Two corridor types stand out.

Corridor A: high risk, weak banks, some mobile coverage

Think of a crisis affected country where:

local banks face strict derisking from correspondent partners

wires in and out are slow, frequently delayed, or sometimes rejected

informal money transfer networks exist but are expensive and opaque

many people hold basic phones or entry level smartphones, but formal bank access is thin

In this corridor, the core use case is often headquarters to local partner, and sometimes local partner to small vendor or community based organization. Direct to household cash might still rely on local agents and cash out points rather than pure digital flows.

Corridor B: host country with strong fintech and expensive friction

Here the picture looks different:

the host country has a functioning banking system and a lively fintech sector

mobile money, neobanks and card programs are widely available

large numbers of refugees or migrants live inside that system but face documentation, KYC, or cost barriers

cross border transfers into the country are slow or expensive because of FX, compliance and fee stacking

In this corridor the pain sits more in the cross border leg. Inside the country, wallets, agents and merchants already exist. The opportunity is to feed those local rails with a cheaper and more reliable cross border mechanism.

A sensible pilot would choose one corridor of each type. That gives a chance to see how Bitcoin linked stablecoin rails behave in both a fragile banking environment and a relatively mature one.

Partner stack and roles

The rail is only one actor. A realistic pilot needs a stack of partners that covers program design, compliance, technical infrastructure and last mile delivery.

Global NGO or UN agency

Owns the program objectives, targeting criteria and accountability to donors

Sets the risk appetite and internal policy for virtual assets

Holds the main relationship with the stablecoin issuer and the Bitcoin infrastructure provider

Defines which legs of the payment flow will use the new rail and which will stay on existing systems

Stablecoin issuer

Provides a fully reserve backed USD stablecoin with clear regulatory status

Supports issuance and redemption both on a Bitcoin linked rail and on at least one other chain that is already common in humanitarian pilots

Offers documentation and attestations that treasury and donors can rely on for reserve and compliance reassurance

This could be a familiar issuer that already appears in first wave pilots. The important thing for the template is that the asset is boring and conservative from a risk committee point of view.

Bitcoin infrastructure partner

Operates or integrates Lightning nodes and the relevant asset protocol, such as Taproot Assets or RGB

Provides an API or dashboard that lets the NGO treasury move stablecoin balances over Bitcoin rails without handling Bitcoin directly

Monitors channel health, liquidity and routing, and is responsible for the technical resilience of the rail itself

This partner is the bridge between the issuer and the local wallets. From the NGO perspective, they should look like a payment processor, not a speculative trading desk.

Local wallet, fintech or off ramp provider

Holds the license to operate as a payments provider or virtual asset service provider in the target country

Onboards beneficiaries and vendors under local KYC rules

Connects the digital stablecoin balances to whatever people already use: bank accounts, mobile money, prepaid cards, agent cash out points

Runs customer support in local languages and handles device, SIM and account issues

In an ideal setup each corridor would have more than one local provider, to avoid concentration risk. In practice, a pilot might start with a single strong partner in each.

Auditor or evaluation partner

Designs and oversees the evaluation framework

Confirms that the baseline and pilot data are comparable

Provides an independent view on whether the rail change produced real differences in speed, cost or delivery efficiency

This does not need to be a big four firm. A research group that has worked on cash transfer evaluations before is often a better fit.

Governance and risk controls

The technology is only as good as the controls wrapped around it. Lessons from Mercy Corps, UNHCR, WFP and UNICEF point to a few governance elements that should be written in before the first dollar moves.

Virtual asset policy and approvals

A simple policy document that defines where and how stablecoins can be used

A list of approved assets and providers

Thresholds for which volumes require extra sign off from treasury or risk committees

Payments on Bitcoin linked rails should go through the same planning and approval logic as any other financial channel, not be treated as experimental side flows.

Segregation of duties

One role can initiate a transfer

A second, separate role approves it

A third role handles reconciliation and reporting

No single staff member should be able to move funds and sign off on their own transfers. This mirrors existing controls for bank payments.

KYC and sanctions screening

Full KYC and screening for local partners, local wallet providers and agents

Risk based KYC for end users, aligned with local regulation and humanitarian accepted practice

Sanctions checks at onboarding and periodic refresh, with clear procedures if a match is suspected

The important point is that the presence of Bitcoin in the rail does not change the responsibilities. It simply changes which ledger the value crosses.

Data protection

Personally identifiable information for beneficiaries and staff stays in the NGO’s existing systems or inside the local wallet provider’s environment under local law

The Bitcoin linked rail carries only pseudonymous or blinded transaction data

Any on chain data that could be linked back to vulnerable people is minimized and treated as a risk in its own right

This is particularly important for people in conflict zones or under authoritarian regimes.

Incident and exit plans

Pre defined steps in case of a major technical incident, such as a routing failure, liquidity crunch or prolonged outage

Criteria for falling back to existing rails if needed

A timeline and mechanism for winding down the pilot and closing channels without stranding funds

An exit plan is a governance signal in itself. It shows donors and regulators that the organization is not locked into an experimental rail.

Metrics and evaluation plan

A pilot that does not measure itself against a clear baseline is a marketing exercise. The template should build in quantifiable measures that mirror what first wave pilots already tracked, with Bitcoin specific questions added on top.

Operational metrics

Time from HQ approval to local partner funds available

Time from local partner funding to beneficiary access

All in cost per 100 dollars delivered, including FX, on ramp and off ramp fees, network costs and any special compliance charges

Rate of failed or reversed transactions

Uptime of the payment rail during the pilot period

These metrics should be collected for both the Bitcoin linked rail and the legacy rail, in the same corridor and over the same period.

Delivery and inclusion metrics

Share of targeted households or partners who actually receive funds

Time window within which a defined percentage of recipients manage to cash out or spend

Geographic coverage of off ramp agents or acceptance points relative to where people live

Incidents where people could not access funds due to device, ID or connectivity issues

These items go directly to the question of whether a new rail is helping or only moving complexity around.

Governance and reporting metrics

Time needed to produce a reconciled financial report suitable for donors

Number of unreconciled or disputed transactions at period close

Number and severity of compliance or audit flags related to the pilot

If shared ledgers and clean rails are doing their work, these numbers should be at least as good as the baseline.

User and staff feedback

Beneficiary satisfaction scores using simple questions about speed, reliability and safety

Local partner and staff views on ease of use compared with prior methods

Qualitative notes on trust, perceived risk and dignity, similar in style to the interviews already used in earlier stablecoin and CVA evaluations

This material does not need to be elaborate. It does need to be structured so that it can be compared meaningfully between rails.

Study design

There are several ways to structure the comparison. One realistic option is:

In each corridor, choose a set of transfers that will continue over legacy rails, and a matched set that will use the Bitcoin linked stablecoin rail

Keep program design, transfer value and frequency, targeting criteria and local partners identical between the two arms

Track the metrics above for both arms over a defined period

The goal is not statistical perfection. It is to be able to say, with a straight face, whether the rail change made a real difference in this environment.

What success would look like

Success needs to be defined before the fact. Otherwise, any interesting anecdote can be used to justify scaling.

For a Bitcoin linked humanitarian pilot, a reasonable set of success conditions might look like this.

At least as fast and as cheap as existing stablecoin pilots

Time and cost performance that matches or improves on the reductions already observed with stablecoins on other rails in similar contexts

No significant increase in failure rates or operational incidents

If the new rail can not keep up with what has already been achieved elsewhere, there is little reason to add complexity.

No degradation in delivery or inclusion

The share of targeted people who actually receive and can use funds should be at least as high as under the current system

Any new exclusion mechanisms introduced by the rail, such as device or connectivity requirements, should be identified and addressed

The right standard is simple: “Do no harm to access.”

Improved or equal governance and reporting

Audit and reconciliation should be as strong as or stronger than under traditional or first wave rails

Compliance teams should feel no less able to monitor and manage risk

If governance quality drops, the rail is not ready for wider use, regardless of how impressive the technical story is.

Demonstrated resilience advantage in at least one stress event

During the pilot period there will almost certainly be at least one disturbance: a bank delay, a regulatory scare, a temporary shutdown

A successful pilot would show that the Bitcoin linked rail remains usable, or recovers more quickly, in at least one such episode

This is the one area where Bitcoin’s design might offer something genuinely new. It deserves to be tested explicitly rather than left as an assumption.

Documented, shareable lessons

A public report that lays out what was tried, what worked and what did not, in enough detail that other agencies can learn from it

Internal notes that capture the boring details of governance, training and daily operations

The template is not only about proving a point for one organization. It is about adding a well documented data point to a field that is still short on careful experiments.

If a pilot can meet these conditions, then a discussion about scaling Bitcoin linked stablecoin rails in humanitarian cash moves from theory toward practice. If it falls short, the result is still valuable. It tells agencies and donors where the real limits are, without waiting for tomorrow’s crisis to make the experiment for them.

Implications for NGOs, donors and stablecoin providers

The pieces are on the table now. Cash and vouchers are mainstream. Stablecoin pilots have escaped the lab and reached real people. Bitcoin rails are no longer a thought experiment. They exist as live infrastructure that moves value every day.

The question becomes practical. Who should do what next.

For NGOs and UN agencies

Humanitarian organizations sit closest to the people who will feel the impact of any new rail. The main implications land here.

Treat rails as a policy decision, not just an IT choice

The choice between legacy banks, first wave stablecoin rails and Bitcoin secured rails is not only technical. It touches fiduciary duty, legal exposure, staff safety and the dignity of recipients. That belongs in risk committees and executive discussions, with clear criteria and agreed red lines.

Start from the program, not the protocol

The core design of a cash program should not revolve around a rail. It should revolve around who needs help, what they need, and how they can realistically access value. Where a new rail fits is a secondary question. The pilots that worked best kept the core program logic intact and swapped out specific payment legs that were clearly broken.

Build virtual asset literacy into finance and field teams

Treasury, compliance, program managers and local finance officers all need a shared vocabulary. Not everyone has to be a protocol expert. They do need to understand what a stablecoin is, how custody works, where risks sit, and what a Bitcoin secured rail would change in their day to day work. Without that shared literacy, decisions drift toward either blanket rejection or blind enthusiasm.

Use comparison, not replacement, as the first step

Single arm pilots prove almost nothing. The next wave should put legacy rails and new rails side by side inside the same program. Same people, same amounts, same context. Different infrastructure underneath. That design gives leadership something solid to work with, and it can stop the only half helpful conversation about “crypto good” versus “crypto bad”.

Preserve optionality

Any move toward Bitcoin secured stablecoin rails should keep an exit path open. That means clear procedures for falling back to first wave stablecoin rails or even to pure banking rails if needed. It also means contract structures that do not trap an agency in one provider’s node network or one asset protocol.

For donors and development finance institutions

Donors and DFIs rarely choose the rail themselves. They do shape what is possible. The way they write conditions, issue calls and react to pilots can either encourage careful experimentation or shut it down.

Ask for baselines, not buzzwords

It is easy to ask implementers to “use blockchain” or “leverage digital innovation”. It is more useful to ask for a clear baseline, a credible evaluation plan and a short list of concrete metrics. Time to disburse, all in cost per one hundred dollars delivered, share of funds reaching end users, audit quality. If those numbers are present, the rail discussion becomes grounded.

Fund comparisons, not showcases

A pilot that uses a new rail in isolation gives everyone an impressive story and very little evidence. Donors are in a position to insist on comparative designs that put new rails up against the current best option. They can also fund independent evaluators to sit between implementers and infrastructure providers and keep the results honest.

Focus on safeguards as much as speed

There will always be pressure to move money faster. That pressure can make people overlook privacy, security and political risk, especially when the rail includes public ledgers or assets that attract public attention. Donors can insist that any Bitcoin linked or stablecoin based solution bring at least the same level of protection for vulnerable people as the legacy systems, and ideally more.

Recognize when resilience matters more than optics

Some corridors will be controversial. They may involve sanctioned jurisdictions, non state armed groups nearby, or governments that donors find uncomfortable. In those places, the resilience properties of Bitcoin based rails may matter more than the headlines. A frank conversation about that trade off is better than leaving field teams to operate in the grey.

For stablecoin issuers and Bitcoin companies

For issuers and Bitcoin infrastructure firms, humanitarian corridors can be attractive and uncomfortable at the same time. They are visible, politically sensitive and operationally demanding.

Design for governance, not just throughput

A rail that can handle thousands of transactions per second is impressive. A rail that helps an NGO close its books quickly and defend itself in an audit is more likely to be adopted. That means features for clean reporting, account level controls, segregation of duties and easy export of transaction histories in forms that finance teams actually use.

Build products that hide protocol complexity

Program managers do not want to learn about HTLCs, channel reserves or client side validation trees. They want to know whether funds will arrive in time for a distribution and how to support a field officer who has lost a phone. Interfaces and service models should reflect that reality. The better the abstraction, the easier it will be for conservative organizations to say yes.

Commit to boring, transparent economics

In humanitarian contexts, hidden fees and opaque FX spreads are a trust killer. Providers who want serious NGO business will need to be clear about where they make their money, how spreads are set and how that compares to legacy costs. They will also need to be ready to operate on thinner margins in exchange for stable, reputationally valuable partnerships.

Be honest about where Bitcoin helps and where it does not

Bitcoin anchored rails will not solve poor identity systems, political interference, or weak local institutions. They will not remove the need for due diligence on local partners or for fraud controls. They can improve speed, reduce some costs and offer resilience where banks pull out. Companies that are precise about those boundaries are more likely to be trusted.

When dollars really do need to move tomorrow

In a well lit office in a safe city, the difference between a seven day wire and a same day transfer can feel abstract. In a camp, a floodplain or a border town, it shows up as whether a family eats this week or next. Stablecoins and modern payment rails cannot fix every part of that story, but they can remove some of the friction that no one wanted in the first place.

The experience of the first pilots is clear enough. When fully backed digital dollars replace the slowest, most fragile legs of humanitarian payments, programs can move faster and keep more value intact on the way to recipients. The details have been messy, but the direction is not in doubt.

Bitcoin secured rails now enter that picture as an option, not a mandate. They bring a different settlement fabric, different resilience properties and a growing ecosystem of tools. The responsible next step is not to proclaim them the answer. It is to design a small number of careful pilots that put them alongside existing solutions, measure the results and share what happens.

If those pilots show that Bitcoin anchored dollars can deliver the same gains as the first wave, or more, in the hardest corridors, then agencies and donors will have a new tool they can reach for when tomorrow really is too late. If they do not, the field will still have learned something valuable, and the next family waiting for a promised payout will be no worse off for the experiment.